Foreigners can own houses and property in Mexico. Mexico Real Estate has a lot to offer in terms of great weather, beautiful scenery, and authentic Latin American culture; plus, you will find lots of affordable options when buying real estate in Mexico. However, there are 5 things you need to know before buying a property in Mexico.

#1 There are special rules when buying a property near the coast

Generally speaking, there are no restrictions on the ownership of residential property or buying real estate in Mexico, and you can hold the title in your own name. However, if the property is near the coast or an international border special rules will apply.

Properties within 50 km of the coast or 100 km from a border will have to purchase the property(a house or a condo) through a trust with a Mexican bank known as a fideicomiso. Fideicomiso is similar to a Land Trust in the United States. You need to renew it every 50 years and that costs on average $600 per year, and is set up during the closing and title point of the sale.

It should be noted that all real estate transactions in Mexico require the involvement of a notary (Notario Público) for all the paperwork and documentation requirements.

The benefits of having your property in a trust are the level of asset protection and estate planning—using beneficiaries and contingent beneficiaries—without having to probate a Mexican will or follow normal probate protocols.

#2 Be aware of “Ejidos”

Sometimes, when you see an incredible and irresistible opportunity in Mexico, it could be an “Ejido”. “Ejido” land is communal agricultural land, which was granted to a community (usually an indigenous community).

In order to buy some of it, you would need the approval of 100% of the community members, separation of your parcel from the ejido, and conversion of that parcel to a freehold title. Converting ejido land to private ownership is a complicated and difficult process, which is why so many have ignored doing it.

#3 “Notarios” play an important role – and are not impartial

All real estate transactions in Mexico require the involvement of a “Notario Público” for all the paperwork and documentation requirements. These notaries have significantly more experience and responsibility than a typical notary public in other countries and thus the two should not be confused.

The notary is appointed by the state governor, must be an attorney with at least five years of experience, and is representative of the buyer in the process. The notary will perform a title search, prepare all the paperwork, process the real estate transaction, record the new title with the municipality, and collect the taxes and fees.

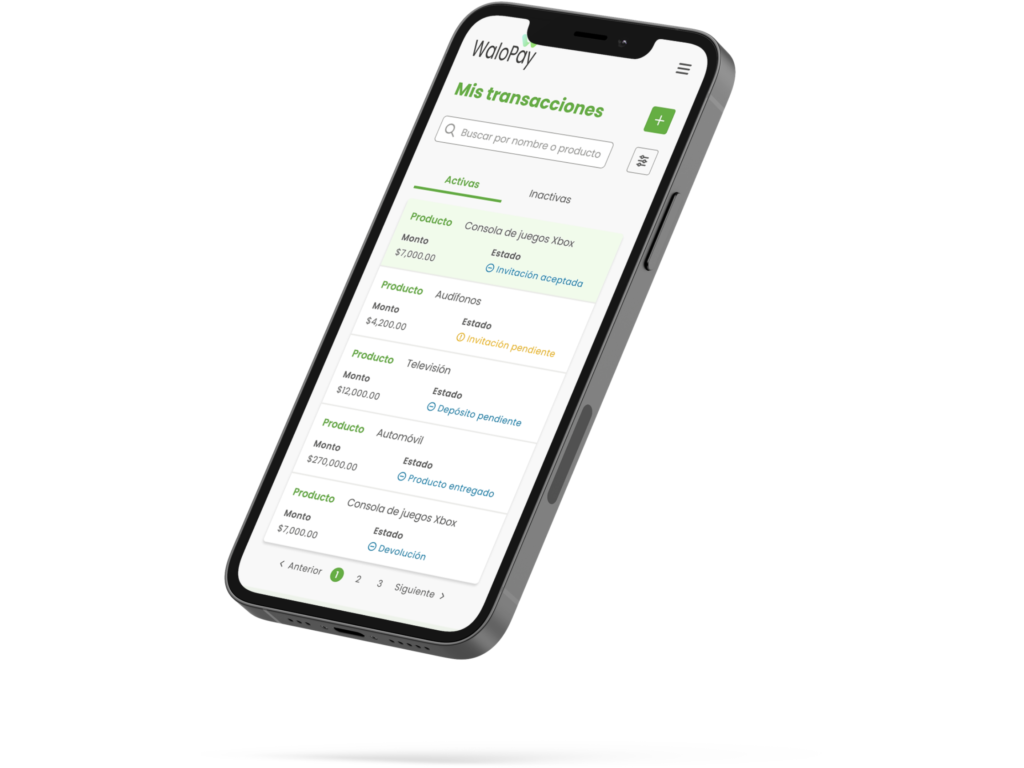

#4 Use Escrow on every deposit or payment

Escrow accounts are a fairly new thing in Mexico. This really depends on the seller, and if the seller wants to arrange these services. If a seller does not wish to set up the escrow, but the buyer requests it, then many times the buyer is responsible for the escrow setup fees (through WaloPay is 0.5% of the transaction value, capped at a maximum fee of $700 US dollars).

But, whatever you do, don’t give direct deposits to the seller. “Notarios” might be the logical, neutral third party to hold this money—won’t hold deposits in their bank accounts, as they don’t want the tax liability on the funds. If you’re working with an attorney or real estate agent, they will likely have a system in place they can recommend. If the real estate agent you’re working with he’s honest, there probably won’t be any trouble. But if he runs off with your funds, there won’t be much you can do about it.

#5 Consider Closing Costs in your budget

Before buying real estate in Mexico, make sure you are considering the closing costs into your budget. Real estate closing costs in Mexico consist of various fees and expenses. They generally total between 4% to 6% of the purchase price. These costs are always the responsibility of the buyer. The seller, on the other hand, will have to pay other real estate fees and their capital gains taxes.